To be E or not to be E

CLA Midlands Rural Surveyor John Greenshields looks at the key options for permitted devlopment

Many members are looking to diversify their business in response to the gradual loss of traditional farm subsidies and to increase their revenue streams.

With a sizeable chunk of members looking to get into glamping or holiday lets, as a way to bring in additional funds. However there are other options. Options that for some members may be easy to utilise and could be more suitable for what they are trying to achieve.

As you should always remember that diversification should work well within the wider business and not become too much of a burden relative to the return you are achieving.

Below, I will explore some of the key permitted development options with you. These rights periodically change so it is always worth taking professional advice to ensure you meet the correct criteria in the Government’s alphabet soup of planning permitted development rights.

Use Class E – Increased Commercial Changes of Use without a need for planning

If you are looking to diversify it is worth checking if you can make use of, what is referred to as, Class E. This is a permitted development right that could make your business more responsive to your particular needs to change the use of a particular building, especially as we move into a post-Covid world.

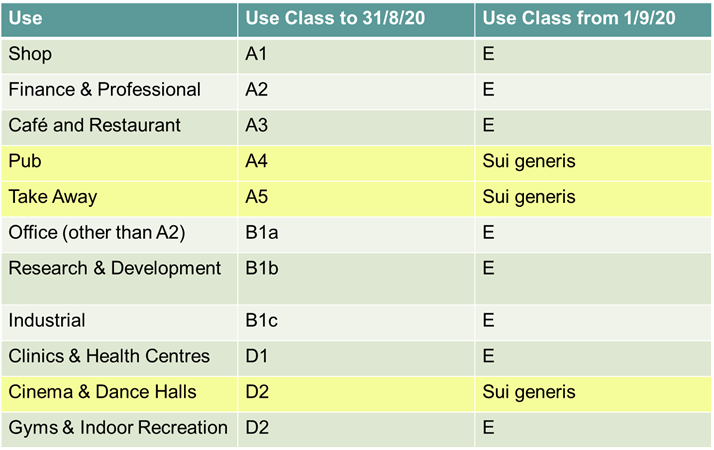

The right has extended what you are allowed to do, in terms of a wider range of uses of a building, without having to go to your local authority to ask for permission. As you need planning permission to change the use of a building between different use classes (i.e. between old use Class A to B) but not if you are changing the buildings use within the same use Class (i.e. new use Class E).

So now you can change a shop to an office, without the need for planning and vice versa. For more details of what is included in use Class E please see the below table.

Class MA – Change of Use from Commercial to Residential

There are a few other potential rights that members should be aware of. These include Classes MA and Class R. Class MA allows you to convert commercial property, which qualifies as Class E, to residential.

This could be a very useful way to create a much needed dwelling for family or staff, in the countryside where historically it has been hard to create a new dwelling.

Class Q – Change of Use from Agriculture to Residential

This right is the commercial equivalent to Class Q, a right probably more familiar to member. As a reminder, Class Q allows an agricultural building to be converted to residential. For more information about the criteria please see the below CLA Guidance Note.

Class R – Change of Use from Agriculture to Commercial

For some, Class R may ring a bell. As it has been with us since 2015 and allows you to convert an agricultural building to flexible commercial use. This is an attractive right which can be utilised and the CLA has its own Guidance Note to provide you with more information.

With all diversification projects there are other items that you should always consider. A list of the key considerations can be seen below and you should always seek bespoke advice, which is free to all CLA members.

- Do you understand your potential responsibilities within the construction phase, as laid out in the Construction (Design and Management) Regulations 2015? Have you got appropriate utilities?

- Have you checked whether the project is viable and you are happy to have such a change of use on your farm. Your viability should also consider Business Rates (for more information click here) which would be payable to your local authority?

- Are there any planning restrictions?

- Do you have appropriate insurance? For a quote please visit its website.

- Will you need to consider Building Regulations?

- What will be the impact on any Inheritance Tax reliefs? Find out here

- Is a change of ownership appropriate? Are there other tax implications? More information here.

- Are there any other reservations that you may have?